Showing 7 Cards

Sort By Column Name:

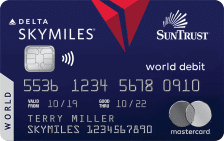

Delta SkyMiles® Debit Card

Delta SkyMiles® Debit Card

At a Glance

The Delta SkyMiles® Debit Card from SunTrust Bank is a co-branded airline rewards debit card that offers a 5,000 SkyMiles sign-up bonus, basic miles on everyday purchases, and more – for a variable annual fee (which SunTrust, now Truist, waives for the first year).

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- No annual fee for the first year

- Earn 1 miles for every $2 spent on eligible purchases

- Miles never expire

- Annual Fee: $0 for the first year, up to $95 after that

- Minimum Deposit Required: $100

- You bank with Truist

- You’re an existing Delta SkyMiles member

- You’re not looking for a credit card

- You meet the requirements for Truist Advantage Preferred

SunTrust Cash Rewards Credit Card

SunTrust Cash Rewards Credit Card

- 11.24% to 21.24% variable based on creditworthiness and Prime Rate Regular Purchase APR

- 11.24% to 21.24% variable based on creditworthiness and Prime Rate Balance Transfer APR

- 24.99% variable based on the Prime Rate Cash Advance APR

- 0% for 15 months from account opening date Intro Purchase APR

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- 5% cash back on up to $6,000 spent on gas and grocery purchases in the first twelve months of account opening

- Unlimited 2% cash back on gas and grocery purchases after introductory bonus cash back period ends

- Unlimited 1% cash back on all other qualifying purchases, no annual fee

- No annual fee

- Intro Purchase APR: 0% for 15 months from account opening date

- Regular Purchase APR: 11.24% to 21.24% variable based on creditworthiness and Prime Rate

- Intro Balance Transfer APR: 0% for 15 months from account opening date

- Balance Transfer APR: 11.24% to 21.24% variable based on creditworthiness and Prime Rate

- Balance Transfer Transaction Fee: Either $10 or 3% of the amount of each transfer, whichever is greater

- Cash Advance APR: 24.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 4% of the amount of each cash advance, whichever is greater

- Late Payment Penalty Fee: Up to $39

- Return Payment Penalty Fee: Up to $39

- N/A

SunTrust Travel Rewards Credit Card

SunTrust Travel Rewards Credit Card

- 11.24% to 21.24% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 11.24% to 21.24% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 24.99% variable based on the Prime Rate Cash Advance APR

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- $250 statement credit when you spend $3,000 in the first three months of account opening

- 3% unlimited cash back on travel qualifying purchases

- 2% unlimited cash back on dining and 1% unlimited cash back on all other purchases

- No foreign transaction fees

- Regular Purchase APR: 11.24% to 21.24% variable based on creditworthiness and the Prime Rate

- Intro Balance Transfer APR: 0% for 15 months from account opening date

- Balance Transfer APR: 11.24% to 21.24% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: Either $10 or 3% of the amount of each transfer, whichever is greater

- Cash Advance APR: 24.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 4% of the amount of each cash advance, whichever is greater

- Annual Fee: $0 for the first year; $89 after that

- Late Payment Penalty Fee: Up to $39

- Return Payment Penalty Fee: Up to $39

- N/A

SunTrust Prime Rewards Credit Card

SunTrust Prime Rewards Credit Card

- 11.24% to 21.24% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 11.24% to 21.24% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 24.99% variable based on the Prime Rate Cash Advance APR

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- 3-year introductory APR offer at the Prime Rate on all balance transfers made within the first 60 days of account opening

- Intro balance transfer fee of $0 when you transfer a balance during the first 60 days your account is open

- 1% unlimited cash back, no annual fee, and no foreign transaction fees

- No annual fee

- Regular Purchase APR: 11.24% to 21.24% variable based on creditworthiness and the Prime Rate

- Intro Balance Transfer APR: Prime Rate for the first 36 months for all balances transferred within 60 days of account opening

- Balance Transfer APR: 11.24% to 21.24% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: None for all balances transferred within 60 days of account opening, then $10 or 3% of the amount of the transfer, whichever is greater

- Cash Advance APR: 24.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 4% of the amount of each advance, whichever is greater

- Late Payment Penalty Fee: Up to $39

- Return Payment Penalty Fee: Up to $39

- N/A

SunTrust Secured Credit Card

SunTrust Secured Credit Card

- 19.99% variable based on the Prime Rate Regular Purchase APR

- 19.99% variable based on the Prime Rate Balance Transfer APR

- 24.99% variable based on the Prime Rate% Cash Advance APR

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Earn 2% cash back on up to $6,000 spent annually on gas and groceries

- Earn 1% unlimited cash back on all other qualifying purchases

- Earn interest on your security deposit while you build your credit

- Get set up with SunTrust Loyalty Cash Bonuses

- Regular Purchase APR: 19.99% variable based on the Prime Rate

- Balance Transfer APR: 19.99% variable based on the Prime Rate

- Balance Transfer Transaction Fee: Either $10 or 4% of the amount of each transfer, whichever is greater

- Cash Advance APR: 24.99% variable based on the Prime Rate%

- Cash Advance Transaction Fee: Either $10 or 4% of the amount of each cash advance, whichever is greater

- Annual Fee: $32

- Foreign Transaction Fee: 3% of the transaction amount in U.S. dollars

- Late Payment Penalty Fee: Up to $39

- Return Payment Penalty Fee: Up to $39

- Minimum Deposit Required: $300

- N/A

You’ve viewed 5 of 7 credit cards

- Alabama

- Arkansas

- Florida

- Georgia

- Maryland

- Mississippi

- North Carolina

- South Carolina

- Tennessee

- Virginia

- Washington, D.C.

SunTrust also used to have branches in West Virginia, but these were closed in 2018. The bank also has over 2,100 ATM locations, in addition to those of BB&T. For a complete listing of SunTrust Bank branches, as well as ATM locations for SunTrust and BB&T, please visit the bank’s location page.

SunTrust Credit Cards

All SunTrust Bank credit cards are Mastercard products. While Mastercard is the second-largest payment network (behind Visa), Mastercard is accepted in more countries than Visa (212 countries vs. 200).

All Mastercard credit cards feature the following protections and security features:

- Zero Fraud Liability: Cardholders pay nothing if their card is subject to unauthorized use or theft.

- Mastercard Global Service: Emergency assistance nearly anywhere in the world, 24/7. Services include lost card reporting and replacement, emergency cash disbursement, and more.

- ID Theft Protection: Complimentary credit report monitoring that alerts cardholders to any changes or fraud concerns.

FAQs About SunTrust Bank

Here are answers to common questions about SunTrust:

- According to reports, SunTrust sues either TransUnion, Equifax, or both, for checking an applicant’s credit history.

- Most SunTrust credit cards require a good credit score. The bank’s secured credit card, however, doesn’t require any credit history – just an associated checking account with the bank.

- The routing number for SunTrust Bank is 061000104.

- BB&T merged with SunTrust in 2019 to form Truist Financial Services.

Find the Best Card for You

The team at BestCards.com knows how hard it is to find your perfect credit card. This is especially true if you don’t have the right tools and knowledge. That’s why we offer insightful credit card reviews, as well as informative articles to guide you every step of the way. Browse our 1,000 reviews and find your best card today.

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.