Visa Purchases Fintech Currencycloud for $962 Million

Visa is set to purchase fintech Currencycloud in a deal worth over $900 million. This is Visa latest step into fintech – read more here:

Visa is set to purchase fintech Currencycloud in a deal worth over $900 million. This is Visa latest step into fintech – read more here:

Upgrade, Inc. has launched the Upgrade Bitcoin Rewards Visa – the first generally available crypto credit card in the U.S.

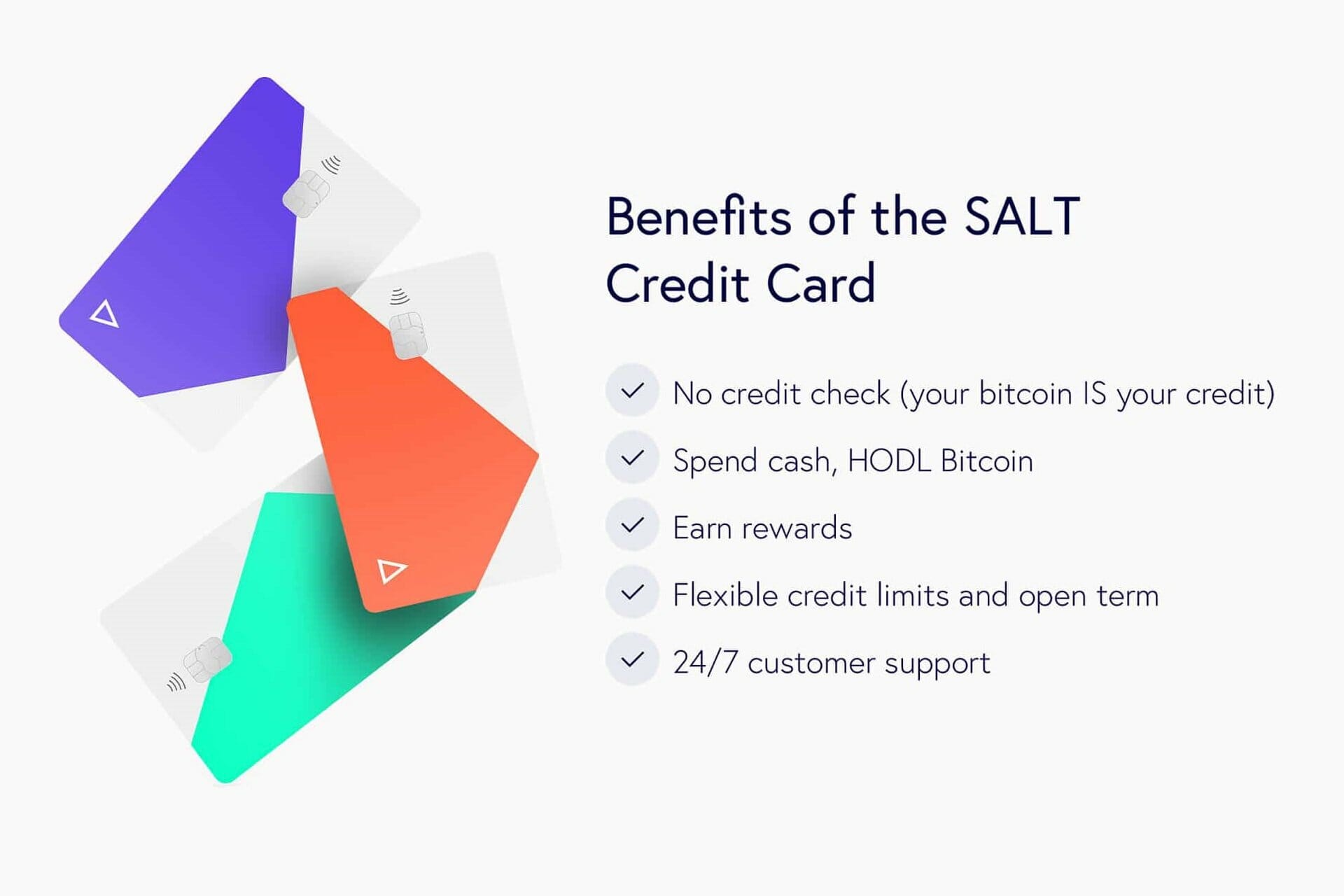

The SALT Card waitlist is now open for potential applicants to the world’s first secured crypto rewards credit card.

Mastercard is testing the suitability of the USDC token for processing cryptocurrency payments. Here is all you need to know.

Mastercard India is facing a ban on issuing new credit cards due to data storage violations. Here is what you need to know.

Goldman Sachs is launching Apple Pay Later, a new Buy Now, Pay Later service that uses Apple Wallet and doesn’t need the Apple Card.

U.S. consumer borrowing rose at record levels in May according to the Federal Reserve. Should you consider a new credit card or refinance?

Emirates Pay is the world’s first airline payment platform that doesn’t require a credit card or debit card to book.

Credit reporting in the US is a hot-button issue for many, but would a public credit agency help, or hurt, consumers? Here’s what to know.

The BlockFi Rewards bitcoin credit card is now live for select waitlist members. Find out about one of the most exciting crypto cards here:

Splitit, a popular buy now pay later (BNPL) service is now offering an in-store financing option, thanks to mobile wallet connectivity.

Visa has agreed to purchase Swedish fintech startup Tink, reigniting its interest in open banking – here is what you need to know: