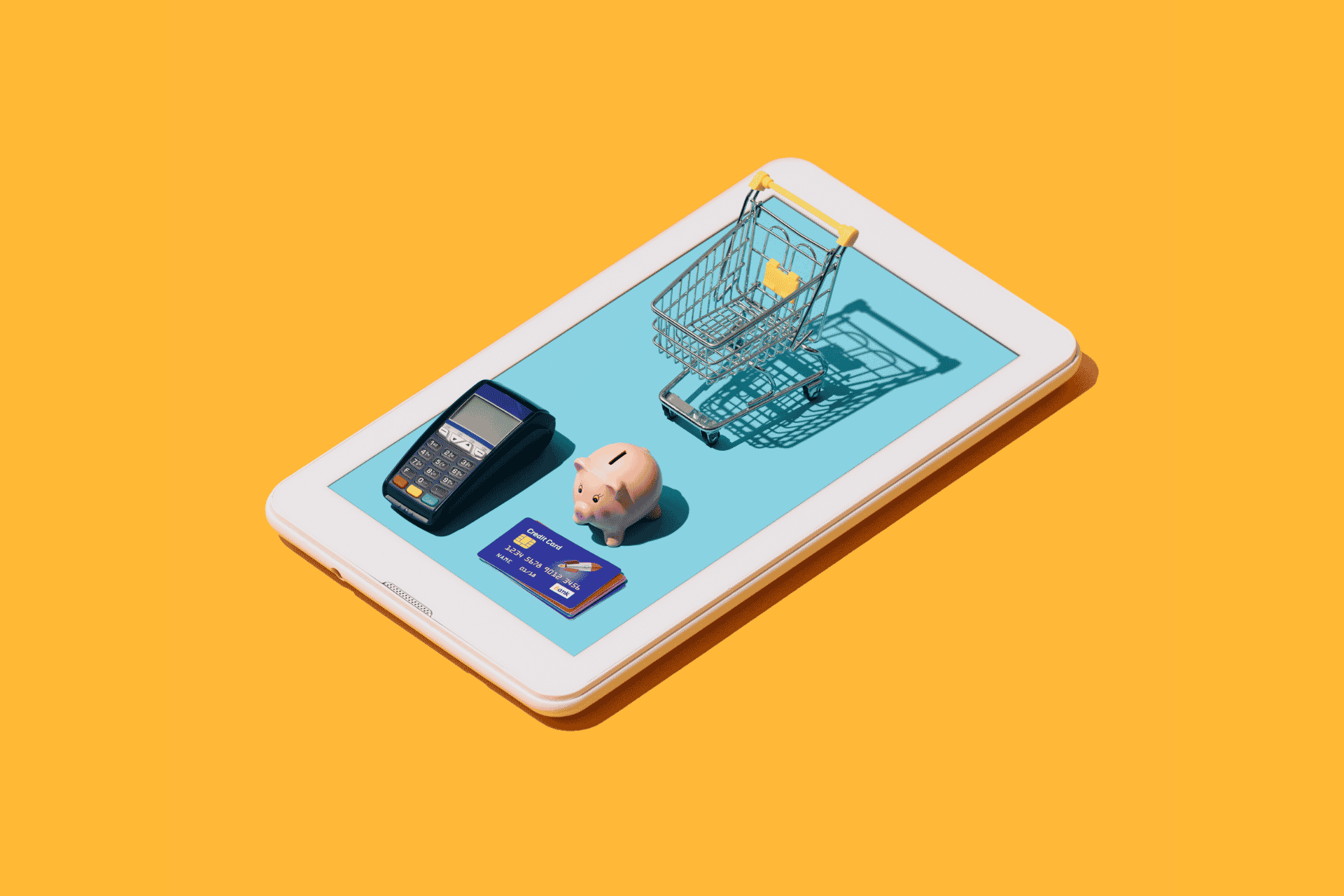

Family Finances – 5 Lessons to Teach Your Kids About Credit Cards

It’s never too early to practice basic financial lessons and create positive money habits. Here are five lessons to teach your kids about credit cards.

It’s never too early to practice basic financial lessons and create positive money habits. Here are five lessons to teach your kids about credit cards.

Want to earn more credit card rewards? Follow our tips and get the most out of your credit card to enjoy a larger points, miles, or cash back total.

Credit cards are powerful financial tools, but the interest charges you pay on them can be overwhelming unless you know a few workarounds to avoid paying interest altogether.

Building credit from the ground up and trying to raise your FICO score requires active commitment and discipline to see positive results.

Just because you don’t understand how credit card debt works doesn’t mean that you should avoid financial planning or be afraid to apply for a credit card.

Most credit counselors and experts agree on these key steps for reversing negative fortune and getting a positive credit score.

Your credit utilization ratio is important if you want a great credit score. Learn how to keep your utilization ratio low.

Using a credit card can aid your budget during these times of inflation (and even after). Check out the best credit card perks for fighting inflation here.

Knowing what interest charges actually are and how credit card interest is calculated can give you the knowledge to get out of debt faster.

Wondering how to get a super-prime credit score? Think excellent credit is out of reach? Learn the habits of those with the best credit scores to copy now!

There are pros and cons about paying your bills with a credit card. Learn everything you need to know to find out if it’s right for you.

Bank of America has its own credit card rules – similar to Chase’s 5/24 rule. Here is what you need to know about 7/12 and 3/12 rules: