by Cory Santos | Last updated on September 30th, 2023

Disney Visa Card

Disney Visa Card

Disney Visa Card

- 18.49% to 27.49% variable Regular Purchase APR

- 18.49% to 27.49% variable Balance Transfer APR

- 29.49% variable based on the Prime Rate Cash Advance APR

- 0% for 6 months after select Disney vacation package or real estate interest purchase in a Disney Vacation Club® Resort Intro Purchase APR

At a Glance

The Disney® Visa® Card shines when shopping and redeeming with Disney, offering plenty of perks and savings for enthusiasts of the household name. Disney creates some of the most magical moments in our lives, and the Disney® Visa® Card allows cardholders to reach these magical memories with every eligible purchase they make with their card.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- $150 Statement Credit after you spend $500 on purchases in the first 3 months from account opening

- Enjoy 0% promotional APR for 6 months on select Disney vacation packages from the date of purchase, after that a variable APR of 15.99%

- Save 10% on select Disney and Star Wars purchases at Disney store and shopDisney.com

- Receive 10% off select merchandise purchases of $50 or more at select locations at the Disneyland® and Walt Disney World® Resorts

- Earn 1% in Disney Rewards Dollars on all your card purchases with no limits to the amount you can earn

- No annual fee

- Intro Purchase APR: 0% for 6 months after select Disney vacation package or real estate interest purchase in a Disney Vacation Club® Resort

- Regular Purchase APR: 18.49% to 27.49% variable

- Balance Transfer APR: 18.49% to 27.49% variable

- Balance Transfer Transaction Fee: Either $5 or 5% of the amount of each transfer, whichever is greater

- Cash Advance APR: 29.49% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 5% of the amount of each transaction, whichever is greater

- Penalty APR: Up to 29.99% variable based on the Prime Rate

- Foreign Transaction Fee: 3% of the transaction amount in U.S. dollars

- Late Payment Penalty Fee: Up to $40

- Return Payment Penalty Fee: Up to $40

- You often shop for Disney products

- You travel to Disney locations or book travel with Disney

- You wish to earn rewards and plan to redeem them towards Disney products

- You do't want to pay an annual fee

The Disney® Visa® Card Review

The Happiest Place on Earth is always within grasp for Disney Visa Cardholders. The card, for Chase, allows Disney fanatics to earn Disney Reward Dollars (DRDs) with every purchase.

Statement Credit

The Disney Visa Card comes with a simple introductory bonus: a $100 statement credit after making $500 in purchases within the first 3 months the card. While this bonus isn’t exceptional – nor will it entice any new applicants – it is something that can add a little extra value to those who plan on making the most use of the card.

How to Earn Rewards

The Disney Visa Card is the no annual fee sibling of the Disney Premier Visa. Because the card charges no fees for use, it earns points at a lower rate than it’s bigger sibling. The card makes a flat-rate 1% back in DRDs on every purchase.

One of the frustrating aspects of the card is that it doesn’t offer bonus points or accelerated earnings – even at Disney parks. Regardless of where you swipe the card, you’ll get 1% back – that’s it.

How To Spend Disney Reward Dollars

Disney Reward Dollars have a value of approximately one cent per point. This means that cardholders would need to spend $100 on purchases with their card to earn just 1 DRD. To break it down further, here’s how much you would earn at various spending levels:

- $5 will receive $0.05 worth of Disney Reward Dollars

- $500 will earn $5 worth of Disney Reward Dollars

- $5,000 will receive $50 value of Disney Reward Dollars

DRDs do have some flexibility in redemption. Award options include:

- Disney Hotels & Resorts –DRDs apply towards accommodations and room charges at most Disney Resorts (U.S. locations only).

- Theme Park Admission Tickets –DRDs apply to both general admission tickets and annual pass memberships at Disney Hollywood Studios®, Disney California Adventure® Park, and Disneyland® Park.

- Theme Park Vendors – Many park vendors and restaurants will accept Disney Reward Dollars as a form of payment. They will even return used reward dollars to your account in the event of a refund. This also includes additional in-park activities such as guided tours, photo passes, and more.

- Merchandise –Use DRDs at all Disney merchandise locations, as well as when shopping at ShopDisney.com.

- Disney Cruise Line –Use DRDs towards cruise bookings via DisneyCruiseLine.com or for onboard purchases, upgrades, or services.

- Movie Tickets – Disney is partnered with AMC theaters to allow cardholders to pay for tickets to Disney, Disney-Pixar, and Star Wars movie tickets.

Special Disney Financing

The Disney Visa Card comes with a unique 0% intro APR offer. Unlike other cards which offer no interest on balance transfers, the Disney Card provides new accounts with 0% APR for the first six months on select Disney vacation packages. This makes the card a decent option for those who are considering a family getaway to the Magic Kingdom, Disneyworld, or any other park – but want to save money for use on-site.

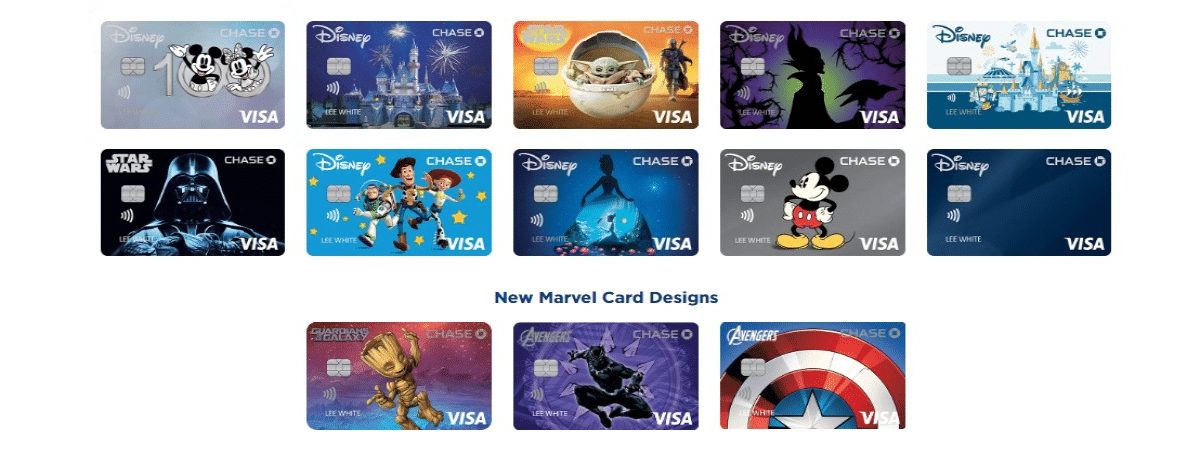

Choose Your Own Card Design

The Disney Visa lets you select from a wide range of exciting card designs – letting you get the perfect card to showcase your fandom. Here are the latest card images to choose from:

Marvel Unlimited Savings

Chase Disney Visa credit cardmembers receive 20% off the first year of an Annual Marvel Unlimited subscription as a new perk (effective 10/1/23), which includes:

- Digital access to over 30,000 Marvel comics, including those exclusive to Marvel Unlimited

- Upgrade membership to include an exclusive membership kit, including a limited-edition Marvel Legends action figure, pin, exclusive comic, and exclusive patches associated with recent brands or spotlighted IPs.

Other Card Features

Other features of note with the card include 10% savings on select Disney purchases. The categories that earn these additional savings are all purchases at ShopDisney.com and any merchandise purchases of over $50 at Disneyland and Walt Disney World Resorts.

Which Disney Visa Card Is Right for You?

Not sure which Chase co-branded Disney Rewards credit card is right for you? Here is a quick breakdown of the two Disney credit cards to help give you a better idea:

| Disney Premier Card | Disney Visa Card | |

|---|---|---|

| Rewards | Earn 2% in Disney Rewards Dollars on card purchases at grocery stores, restaurants, gas stations and most Disney locations | Earn 1% in Disney Rewards Dollars on all your card purchases with no limits to the amount you can earn |

| Welcome offer | $300 Statement Credit after you spend $1000 on purchases in the first 3 months from account opening | $150 Statement Credit after you spend $500 on purchases in the first 3 months from account opening |

| Annual fee | $95 annual fee | No annual fee |

Disney Visa Card FAQs

Here are the answers to some of the more commonly asked questions about the Disney® Visa® Cards from Chase:

- Chase credit cards typically require good or excellent credit. Applicants will usually need a credit score of at least 670 to be in with a shot of getting approved for a Chase credit card. Of course, there are always exceptions, so you never know if you have a lower score.

The 5/24 rule applies specifically to applicants who wish to open a new personal credit card with Chase. In a nutshell, the 5/24 rule stipulates that, if your account shows five or more credit card applications (which involve a hard inquiry each time you apply for a card) within the last 24 months, your credit card application will be rejected by Chase.

This rule applies to all personal credit cards and applications, from any bank or card issuer, that may appear on your credit report – not just to applications with Chase. This is an internal rule, one that Chase does not formally publish in their terms and agreements or via any official announcements; it came to light after people began to notice that they were denied for credit cards through Chase and took to online forums to discuss the reasons why, and to compare their experiences.

- Check out The Chase 5/24 Rule: What You Need To Knowfor more information.

- Chase offers several Disney discounts through its Disney Debit (as outlined above) and the two Disney co-branded credit cards: the Disney Visa and Disney Premier Visa.

Card Availability

Chase credit, debit, and banking products are available in all 50 U.S. states plus the District of Columbia.

JP Morgan Chase Banking Ratings

How does the Chase Disney Debit and Total Checking stack up? Here are a selection of expert reviews for the card, as well as an overview of JP Morgan Chase as a bank:

| BestCards | Better Business Bureau | TrustPilot |

|

4.5/5 |

3.5/5 |

2/5 |

Should You Apply for the Disney® Visa® Card?

The Disney Visa Card from Chase offers some value for those who plan to make use of it at Disney properties. Even those who want a card that can help them save fr a dream vacation may find great value here. For everyone else, however, the Disney Visa offers less value.

This card is ideal for Disney Annual Passholders, who will most frequently take advantage of the 10% in-park discounts, as well as those with an upcoming Disney vacation who will utilize the 0% APR special financing on vacation packages.

Browse Other Card Offers:

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.