by Cory Santos | Last updated on October 23rd, 2023

New Orleans Pelicans Credit Card

New Orleans Pelicans Credit Card

New Orleans Pelicans Credit Card

- 20.99% to 30.99% variable based on creditworthiness and the Prime Rate Regular Purchase APR

At a Glance

The New Orleans Pelicans Credit Card is a Mastercard from fintech Cardless that provides New Orleans fans their shot at savings on merchandise and more – all for no annual fee.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- No annual fee

- No foreign transaction fees

- Earn 4X points on Pelicans tickets, gas, dining, and bars

- Save 10% off concessions at the Smoothie King Center and at the Pelicans Team Store

- VIP game experiences

- Regular Purchase APR: 20.99% to 30.99% variable based on creditworthiness and the Prime Rate

- You plan to purchase Pelicans season tickets

- You want the chance at a free jersey (or another reward) after meeting a minimum spend requirement

- You don’t want to pay an annual fee

At a Glance

The New Orleans Pelicans Credit Card is a Mastercard from fintech Cardless that provides New Orleans fans their shot at savings on merchandise and more – all for no annual fee.

Ideal for Those Who:

- Plan to purchase Pelicans season tickets

- Want the chance at a free jersey (or another reward) after meeting a minimum spend requirement

- Don’t want to pay an annual fee

New Orleans Pelicans Credit Card Review

The New Orleans Pelicans Mastercard is a fintech credit card from Cardless and the New Orleans Pelicans – one of the NBA’s most popular franchises. The card earns rewards towards unique experiences, merchandise, and exclusive offers from the Pelicans – without any hidden or annual fees.

30,000-Point Sign-up Bonus

The New Orleans Pelicans Mastercard credit card from Cardless differs slightly from the fintech’s credit card for another basketball team – the Cleveland Cavaliers Credit Card. That card offers a free jersey after meeting minimum spending requirements. On the other hand, the Pelicans Credit Card offers 30,000 bonus points after spending $2,000 in three months of account opening.

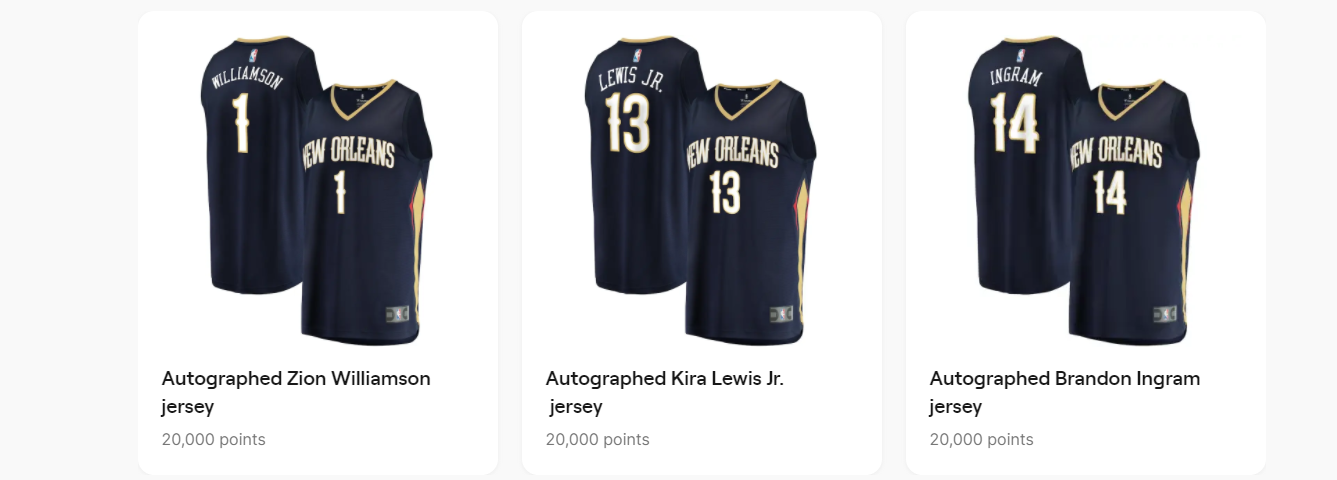

That bonus is worth around $300 and is also the same value as a New Orleans Pelicans replica jersey, making the introductory offer pretty much the same as other Cardless basketball credit cards. Still, it is a great welcome bonus for the New Orleans sports fan that wants to enjoy lucrative rewards and get their hands on the latest replica jersey before the next game.

How to Earn Rewards

The card earns points towards Pelicans gear, experiences, and more. Cardholders earn 4X points on season ticket purchases, rideshares, and streaming services, including Netflix, Spotify, Apple Music, Hulu, or other similar digital streaming services.

The card also earns 4X points on dining (including takeout and delivery and gas, and 1X points on all other purchases. Fans also enjoy up to 10% savings on purchases at the online Pelicans shop and concessions at the Smoothie King Center.

Earning 4X points on season tickets can be a lucrative proposition for the New Orleans fan that wants to deck themselves out in the latest merch before the season starts (thanks to the 10% off New Orleans gear). As season ticket plans run into the thousands of dollars range (or higher), 7X points can mean a considerable tally before the first tip-off (or even mid-season season ticket plans).

Earn Additional Points for Referrals

Cardholders also earn bonus points when they refer friends to any of the credit cards on offer from Cardless. Each successful referral (upon approval) earns the accountholder 10,000 extra points.

How to Redeem Reward Points

Rewards points with the Pelicans Credit Card apply towards memorable experiences, items, gift cards, or statement credits. Using points towards statement credits provides a point value of half a cent per point – and applies towards credits reducing the card’s statement balance.

Gift cards, on the other hand, provide more value for money. Using New Orleans Pelicans Mastercard points for a Pelicans gift card allows cardholders to receive extra value, and points for gift cards are worth one cent per point.

However, the major selling point with the card is the chance at unique Cavs experiences, including various unique perks, including meet-and-greets with the team, team-signed balls or jerseys, honorary benchwarmer experiences, and more.

No Hidden Fees

The Pelicans Credit Card features no foreign transaction fees, late payment fees, return payments, and over-the-limit fees. And, since Cardless products don’t allow balance transfers or cash advances, there are no fees there either.

Other Card Features

Because the Pelicans Credit Card is a Mastercard, cardholders can anticipate the usual protections from the world’s second-largest payment network. These features include:

- Zero Fraud Liability

- ID Theft Protection

- Mastercard Global Service and Assistance

Other notable features include VIP game experiences, such as Pre-game benchwarmer, pre-game tunnel visits, photo and “ball boy” opportunities, exclusive in-person events at the Smoothie King Center, the chance to watch Pelicans practice, and more.

Should You Apply for the New Orleans Pelicans Credit Card from Cardless?

The Pelicans Credit Card is a Jazzy retail card for fans of one of the NBA’s most popular franchises. The card offers many fan-centric perks for the fans who want to show their local sports pride with every swipe.

The 4X points the card earns on tickets (including season tickets), gas, bars, and dining make the card a valuable tool for watching your favorite team play – home and away. Add to that 4X on dining and a decent 30,000-point sign-up bonus, and the Pelicans Mastercard hits many of the right notes and is an attractive retail credit card for the Pelicans fan that wants to broadcast love of all things green worldwide.

Browse Other Card Offers:

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.