by Cory Santos | Last updated on November 9th, 2023

OFFER NOT AVAILABLE

Please note that this credit card offer is currently unavailable. To view more credit card options like this one, please click the link below.

At a Glance

The Save® Wealth Visa Signature Credit Card is a high yield investment credit card from SoFi, Evolve Bank & Trust, and fintech Save. The card offers impressive APY as credit card rewards but comes with a steep annual fee.

Ideal for Those Who:

- Prefer automation to their investment portfolios

- Plan to spend heavily using the card

- Hate confusing credit card rewards categories

- Can manage the annual fee

Save® Wealth Visa Signature Credit Card Review

The Save® Wealth credit card is what is claimed as the “world’s first high yield credit card.” The card, a partnership between Save and SoFi, earns an average of 6.04% APY on all purchases (for Premium cardholders) and features Visa Signature benefits and protections.

Invest Your Rewards

The Save credit card works differently than other rewards credit cards. The card earns rewards via investments instead of offering points, cash back, or other rewards.

Cardholders earn investments for every purchase they make. For every $1 spent on purchases, Save Wealth invests $2.17 on the cardholder’s behalf. After sitting in the cardholder’s account for one year, all returns (minus Save’s fee) from the investment are deposited into the accountholder’s bank account as cash.

There are no caps on returns, no exclusions, and no variable reward categories to manage.

What Are Save’s Fees?

Any investments made on the cardholder’s behalf will be charged a wealth management fee (0.79%) if there are returns. If returns are less than 0.79%, there’s no wealth management fee. There is no spending minimum required to earn investments.

Choose Your Portfolio

Part of the allure of the Save Wealth program is the ability to select the portfolio that is right for you. Save Wealth customers can choose the portfolio that’s right for them, selecting how conservative or aggressive they’d like to be.

Current portfolio asset allocation options include:

- Global Diversified Market

- ESG Focused

- Alternative assets and crypto

More information on Save’s methodology used in calculating and generating the hypothetical performance can be found here.

Save® Wealth Plus

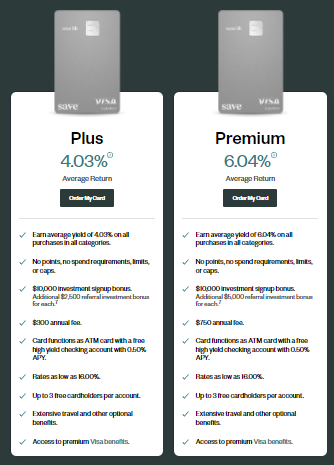

The Save® Wealth credit card is actually two distinct products. The first card option is the Save Wealth Plus Visa Signature, which features a steep annual fee of $300. For that hefty annual fee, cardholders get an average yield of 4.03% on all purchases in all categories. That rate is lower than what is on offer with the Save® Wealth Premium. Still, it is a highly enticing investment option for those that plan to really use their new card to make purchases.

Save® Wealth Premium

The Save® Wealth Premium Visa Signature is the ultra-premium version of the card program. By ultra-premium, I don’t refer to exclusive Visa benefits. Instead, that label comes from the eye-watering annual fee – $750. Cardholders receive approximately 6.04% APY on investments for that price but enjoy little else.

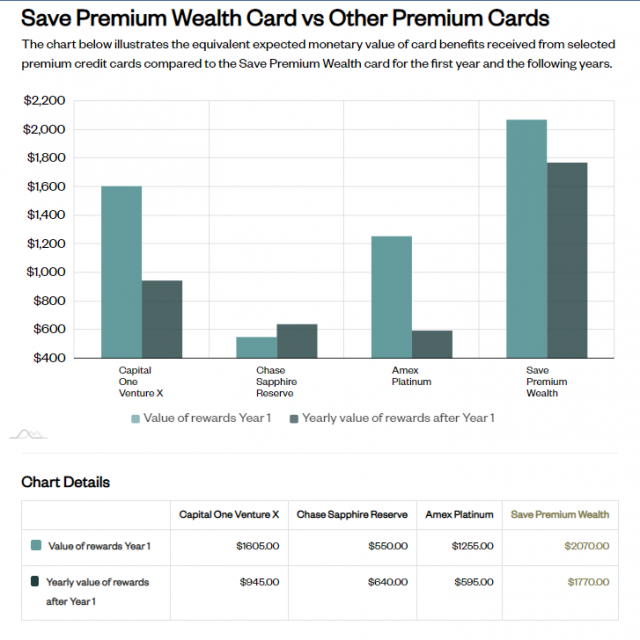

The annual fee places the card on the same level as the Amex Platinum, Chase Sapphire Reserve, and even the Mastercard Gold Card from Luxury Card. All of these cards feature staggering annual fees but offer greater perks and protections than the Wealth Card, however.

All three previously mentioned cards provide lounge access through Priority Pass Select, for example, and lucrative lifestyle benefits and savings. Sure, none of those three prestigious travel cards offer the ability to invest with purchases, but they do provide a greater degree of versatility that the Wealth Premium lacks.

Referral Bonuses

For each successful referral, Save buys a strategy-linked security for each party whose investment value is equivalent to $1,500 for the Core account, $2,500 for the Plus account, and $5,000 for the Premium account. These bonuses are in addition to the $10,000 investment signup bonus.

Save® Wealth Vs. M1

The closest competitor to the Save® Wealth credit card is M1, which issues a credit card and debit card product to customers. The Owner’s Rewards Card by M1, the fintech’s credit card, features up to 10% cash back on select brands, including major names like Netflix, Lululemon, Tesla, Wayfair, and more. Cardholders can invest in the companies they believe in, shop at those companies to earn rewards, and then reinvest their cash back to bolster their portfolio.

The M1 Spend Visa® Debit Card is the no annual fee debit card from M1 that provides an avenue to investment without paying a yearly charge. The Card earns up to 1% cash back and 1% APY on a Spend Plus Account balance.

Save Wealth Plus Card

-

Earn average yield of 4.03% on all purchases in all categories.

-

No points, no spend requirements, limits, or caps.

-

$10,000 investment signup bonus. Additional $2,500 referral investment bonus for each

-

Card functions as ATM card with a free high yield checking account with 0.50% APY

Save Wealth PremiumCard

-

Earn average yield of 6.04% on all purchases in all categories.

-

No points, no spend requirements, limits, or caps.

-

$10,000 investment signup bonus. Additional $5,000 referral investment bonus for each

-

Card functions as ATM card with a free high yield checking account with 0.50% APY

The Owner’s Rewards Card by M1

-

Annual fee waived for M1 Plus customers

-

Earn 10%, 5% or 2.5% cash back on purchases with some of the most popular brand

-

Earn 1.5% back on all other purchases

-

Automatically invest rewards through M1 automation

-

No foreign transaction fees

M1 Visa® Debit Card

-

Up to 1% APY

-

2% loans through M1 Borrow

-

4 ATM fee reimbursements per month

-

No foreign transaction fees

Other Card Features

Other notable card features with Save include Visa Signature benefits, such as:

- Roadside Dispatch

- Auto Rental Collision Damage Waiver

- Cardholder Inquiry Services

- Zero Fraud Liability

- Visa Signature Concierge

- Visa Signature Luxury Hotel Collection

- Extended Warranty Protection

- Travel and Emergency Assistance Services

FAQs About the Save Wealth Credit Card

Here are some of the most commonly asked questions regarding the Save Wealth Visa Signature, along with the answers:

- Per Save: “Assuming you spend $12,500 on the Premium Wealth card (based on $750 annual fee and a hypothetical average annual return of 6.04%) and $7,500 on the Plus Wealth card (based on $300 annual fee and a hypothetical average annual return of 4.03%) you will breakeven and cover the annual card fee.”

- The annual fee is charged on the second billing statement of the year, with no monthly fee option.

- No. ATM withdrawals, cash advances, and other charges do not apply towards rewards.

Card Availability

Save credit and debit products are available in all 50 U.S. states plus the District of Columbia.

Should You Apply for the Save® Wealth Visa Signature Credit Card?

The Save® Wealth Visa Signature Credit Card might seem like an attractive option given the impressive APY it provides, but does the card make sense for your portfolio? If you don’t plan on regularly using the card for expensive purchases, the answer is likely “no.”

Sure, the card comes with an impressive return on investment, but that return requires significant spending to offset the annual fee and make it worthwhile. A $750 yearly fee for a Visa Signature is difficult to justify, but the 6% APY helps. Still, other premium cards may offer greater versatility and travel benefits the Wealth card simply cannot provide.

The M1 Owner’s Rewards Card is a direct competitor to the Wealth Card but offers a more conservative investment policy than Save. Still, that card features an annual fee of $95 (waived for eligible members), which is much more manageable than Save.

Ultimately, the Save® Wealth Visa Signature offers the ideal credit card for a select subset of consumers – namely those that like to spend as big as they save and want a streamlined way to boost their portfolio.

Browse Other Card Options:

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.