by Cory Santos | Last updated on January 19th, 2024

Southwest Rapid Rewards® Plus Credit Card

Southwest Rapid Rewards® Plus Credit Card

Southwest Rapid Rewards® Plus Credit Card

- 21.49% to 28.49% Variable Regular Purchase APR

- 21.49% to 28.49% Variable Balance Transfer APR

- 29.99% Variable Cash Advance APR

At a Glance

The Southwest Rapid Rewards Plus Credit Card is a reliable airline rewards credit card for those who like to fly and prefer Southwest Airlines when they travel. The card earns 2X points on Southwest Airlines purchases and 1X points on all other purchases. The card has an annual fee of $69, which is mostly offset by the cardmember anniversary bonus of 3,000 miles given after each year of membership.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- 3,000 anniversary points each year.

- Earn 2X points on Southwest® purchases.

- Earn 2X points on local transit and commuting, including rideshare.

- Earn 2X points on internet, cable, and phone services; select streaming.

- 2 EarlyBird Check-In® each year.

- Earn 1 point for every $1 spent on all other purchases.

- Member FDIC

- Regular Purchase APR: 21.49% to 28.49% Variable

- Balance Transfer APR: 21.49% to 28.49% Variable

- Balance Transfer Transaction Fee: Either $5 or 5% of the amount of each transfer, whichever is greater

- Cash Advance APR: 29.99% Variable

- Cash Advance Transaction Fee: Either $10 of 5% of the amount of each transaction, whichever is greater

- Penalty APR: Up to 29.99% Variable

- Annual Fee: $69

- Foreign Transaction Fee: 3% of the transaction amount in U.S. dollars

- You fly often and prefer to fly with Southwest

- You plan to use your card in conjunction with other Southwest programs to earn maximum points

- You have a large purchase planned that will allow you to reach the spending requirement on the card within the first 90 days to qualify for a signup bonus

- You plan to use the card primarily for purchases within the United States

Southwest Rapid Rewards® Plus Credit Card

Terms & ConditionsIn-Depth Review: Southwest Rapid Rewards® Plus Credit Card

The Southwest Rapid Rewards Plus Credit Card from Chase Bank is a versatile airline rewards credit card that caters to those who prefer to fly with low-cost carrier Southwest Airlines.

Who Can Benefit from the Rapid Rewards Plus Card?

The Rapid Rewards Plus Card is Southwest and Chase’s “entry-level” credit card. Despite this, the card charges a $69 annual fee but backs that fee up with a handful of enjoyable travel perks.

These features combine to create a co-branded airline card that caters to the casual traveler who wants to enjoy a more carefree travel experience thanks to free bags, priority check-in, and anniversary bonus rewards. This card might be for you if you fly a few times a year and prefer Southwest, regardless of the destination.

How to Apply

Credit Requirements

Southwest credit cards are geared towards “good” or “excellent” credit applicants. A “good” FICO Score is a credit score of 670 or above or a VantageScore of 700+. FICO is most lenders’ credit agency, so this is the best figure to aim for.

Application Requirements

Applying for credit cards from Chase is similar across the different co-brand relationships, Southwest Airlines included. You’ll need the following information to apply for the Plus Card:

- Aged 18 or older

- U.S. mailing address (no PO Boxes permitted)

- SSN or ITIN

- FICO Score above 670 (good)

- Proof of income

You should also be aware of Chase’s 5/24 rule. The 5/24 rule states that applicants likely won’t be approved for a new Chase card if they’ve opened five or more personal credit cards in the previous 24 months.

Reasonable Annual Fee

The Southwest Rapid Rewards Plus Card is the most affordable of the Rapid Rewards personal credit cards, thanks to its modest annual fee. That charge – a $69 annual fee -is $30 less than the Premier Card and a whopping $ 80 per year less expensive than the $149 Priority Card.

Guide to Rewards with the Rapid Rewards Plus Card

Welcome Offer

New Southwest Rapid Rewards Plus cardmembers can enjoy a quality welcome bonus of 50,000 points after spending $1,000 on the card within 90 days of opening an account. That welcome bonus has a cash value of around $600 to $700 when booking an award flight with Southwest, making it an impressive welcome offer given the card’s reasonable $69 annual fee.

How to Earn Points

The Southwest Rapid Rewards Plus Card earns solid, reliable points on all eligible purchases:

- Earn 2X points on Southwest® purchases.

- Earn 2X points on local transit and commuting, including rideshare.

- Earn 2X points on internet, cable, and phone services; select streaming.

- Earn 1 point for every $1 spent on all other purchases.

The double points on Southwest purchases are great – especially when you frequently fly with Southwest. And since the airline currently operates flights to over 100 destinations in 42 states, plus Puerto Rico, Mexico, Central America, and the Caribbean, plenty of great routes ensure you earn top-tier points.

The Plus Card also earns double points for every dollar on various purchases, including local transit, commuting, and rideshares. Cardholders also enjoy 2X points on phone/TV/internet providers and select streaming services. Every other dollar spent with the card earns a single point. There is no limit to the total number of points earnable.

Here is how Chase defines as eligible “streaming services:”

| Apple Music | HBO Max | Showtime | YouTube TV |

| Apple TV | Hulu | SiriusXM | Vudu |

| Disney+ | Netflix | Sling | |

| ESPN+ | Paramount+ | Spotify | |

| FuboTV | Peacock | YouTube Premium |

Earning Points with Fares

| Fare | Details |

|---|---|

| Wanna Get Away | Wanna Get Away is the basic – and lowest cost – fare Southwest offers. The basic, Wanna Get Away fare earns six Rapid Rewards points for every dollar spent with the carrier. |

| Wanna Get Away Plus | Wanna Get Away Plus is the next tier and earns 8X Rapid Rewards points for every dollar spent with the carrier. This fare offers all the features of the basic fare, plus same day stand-by, same day changes, and transferrable flight credits. |

| Anytime | Anytime is the next tier of Southwest fares and offers increased flexibility compared to Wanna Get Away tickets. Anytime fares allow for refunding of canceled trips for up to 12 months – and earn ten points per dollar spent. |

| Business Select | Business Select is the top fare level for Southwest Airlines. Business Select get priority boarding, priority security where available, and a complimentary drink on board, and 12 Rapid Rewards points per dollar spent. |

Earning Points with Partners

You can also earn Rapid Rewards points with Southwest Airlines partners. Members earn 2X Rapid Rewards points for each dollar spent with the following partners:

| Type | Partners | |

|---|---|---|

| Hotel | SPG | Rocket Miles |

| Best Western | Choice | |

| Radisson | Hyatt | |

| Marriott | MGM | |

| Car rental | Alamo | Avis |

| Budget | Dollar | |

| Nationwide | Payless | |

| Thrifty | SuperShuttle Executive | |

| Other | Rapid Rewards points are also earnable when making purchases through the dedicated Southwest Rapid Rewards shopping portal, where members earn points for making purchases with hundreds of leading brands. | |

| Registering with Southwest lets Rapid Rewards members earn one point for every dollar spent when filling up their tank at Marathon gas stations. | ||

| Experiences booked with Southwest Experiences also earn Rapid Rewards points. | ||

Earn Additional Rewards Through Rapid Rewards Dining

Joining the Rapid Rewards Dining program allows Rapid Rewards members to earn points when they eat out. Additionally, new members receive impressive bonuses, including an additional 1,000 points after they dine out three times, an extra 500 points after earning their first 1,500 points through dining, and a thank-you bonus of 300 points after every 1,000 points they earn through the dining program.

Anniversary Bonuses

Southwest Rapid Rewards® Plus cardholders also receive a 3,000-point anniversary bonus on their cardmember anniversary each year. This bonus has a cash value of around $40, recouping much of the card’s annual fee.

How to Redeem Rapid Rewards Points

Southwest Airlines prides itself on its straightforward approach to air travel – and the Rapid Rewards frequent flyer program is no different. Southwest Rapid Rewards points are redeemable for award flights with Southwest, with four distinct tiers: Wanna Get Away, Wanna Get Away Plus, Anytime, and Business Select.

Southwest teams with hotels, car rentals, and other partners to help members maximize their value for money. Other options for redeeming points include making bookings with Southwest partners. Other redemption options include gift cards, merchandise, event access, or statement credits to the Southwest Rapid Rewards Plus Credit Card account.

Related Article: The Ultimate Southwest Rapid Rewards Program Guide

Tips for Maximizing Rewards with Rapid Rewards

While the Southwest Rapid Rewards Plus Card comes with a hefty sign-up bonus, there are plenty of other ways to quickly build up Rapid Rewards points in addition to sign-up bonuses and purchasing flights, including transactions with the following Southwest Rapid Rewards partners:

| Type | Partners | |

|---|---|---|

| Hotel | SPG | Rocket Miles |

| Best Western | Choice | |

| Radisson | Hyatt | |

| Marriott | MGM | |

| Car rental | Alamo | Avis |

| Budget | Dollar | |

| Nationwide | Payless | |

| Thrifty | SuperShuttle Executive | |

| Other | Rapid Rewards points are also earnable when making purchases through the dedicated Southwest Rapid Rewards shopping portal, where members earn points for making purchases with hundreds of leading brands. | |

| Registering with Southwest lets Rapid Rewards members earn one point for every dollar spent when filling up their tank at Marathon gas stations. | ||

| Experiences booked with Southwest Experiences also earn Rapid Rewards points. | ||

Southwest Airlines Travel Benefits

The Plus Card also comes with several other nice Southwest Airlines-centric perks. These benefits include the airline’s Transfarency, meaning cardholders don’t have to worry about paying any hidden fees or change fees. Also, customers can check their first and second bags free of charge with Southwest’s bags fly-free service.

Like other Southwest Rapid Rewards credit cards from Chase, the Rapid Rewards Plus Card offers an impressive selection of Southwest-centric travel features. These Rapid Rewards perks include:

- Anniversary Points Bonus:Cardholders earn three thousand points yearly on their Cardmember anniversary.

- Bags Fly Free: First and second checked bags fly free with Southwest. Weight and size limits apply.

- 2 EarlyBird Check-In® Vouchers Each Year:EarlyBird Check-In® is a low-cost option giving travelers the convenience of automatic check-in before Southwest’s traditional 24-hour check-in.

- 25% Back on In-Flight Purchases:Get 25% back on inflight purchases with Southwest when using the card.

- No change fees on reservations

- Unlimited reward seats

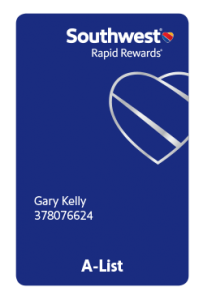

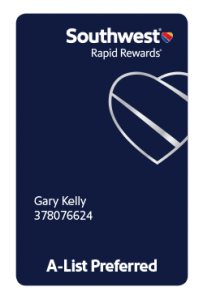

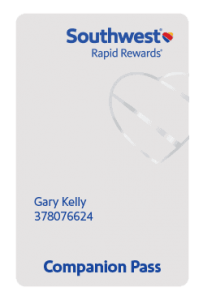

Rapid Rewards Tiers

| Southwest Rapid Rewards Tiers | |||

|---|---|---|---|

A-List |

A-List Preferred |

Companion Pass |

|

| Requirements | 35,000 TQPs or 25 flights. | 70,000 TQPs or 50 flights. | 135,000 CPQPs or 100 flights. |

| Mileage bonus | 25% | 100% | – |

| Free bags | 2 | 2 | 2 |

| Priority check-in | ✔️ | ✔️ | ✔️ |

| Priority security & boarding | ✔️ | ✔️ | ✔️ |

| Same-day changes | Free | Free | Free |

| In-flight Wi-Fi | – | ✔️ | ✔️ |

| Companion flies free | – | – | ✔️ |

Visa Benefits

Chase’s Southwest personal credit cards also enjoy Visa Signature security protections and essential travel benefits. These features include the following:

| Zero Fraud Liability | Cardholder Inquiry Services | Emergency Card Replacement | Luxury Hotel Collection | Extended Warranty Coverage |

| Roadside Dispatch | Lost/Stolen Card Reporting | ID Navigator from Norton | Travel & Emergency Assistance |

Comparisons

Rapid Rewards Comparison

| Rapid Rewards® Priority Credit Card | Rapid Rewards® Premier Credit Card | Rapid Rewards Plus Credit Card | |

|---|---|---|---|

| Annual fee | $149 | $99 | $69 |

| Pts. on Southwest flights | 3X | 3X | 2X |

| Pts. with Southwest partners | 2X | 2X | 2X |

| Other pts. | All three southwest personal cards earn 2X on local transit, internet, cable, phone services, and select streaming; 1X on all else | ||

| Flying perks | 2 Early Bird check-ins, 4 upgrade boardings, $75 travel credit | 2 Early Bird check-ins | 2 Early Bird check-ins |

| In-flight savings | 25% back | 25% back | 25% back |

| Anniversary pts. | 7,500 | 6,000 | 3,000 |

| FTX fee | None | None | 3% |

What We Like About the Southwest Rapid Rewards Card

Reward Categories

One of the best features of the Southwest Rapid Rewards Plus Card is the unique bonus categories the card provides for rewards. Beyond the typical flights, the card emphasizes everyday travel and spending thanks to local commuting/transit and the generous streaming, phone/internet/TV services. These rewards are better oriented to the general needs of most travelers, providing savings at home, on the road, and in the air.

Southwest Benefits

Equally enjoyable are the plethora of Southwest in-flight and airport benefits. These include in-flight savings when using your Plus Card, complimentary early check-ins, priority boarding, and more. These perks don’t include lounge access, but few cards do at this price point. Instead, Southwest gives you the travel essentials to enjoy your next trip.

Anniversary Bonus

The anniversary bonus is another nice feature, helping you reclaim some of the card’s $69 annual fee each year. These points provide a little motivation to ensure you keep the card – though given the card’s rewards, benefits, and transferability, that won’t be likely.

Things to Consider

Annual fee

While the anniversary bonus helps recoup some of the card’s annual fee, it would be much more preferable if the card offered no annual bonus in exchange for no annual fee. What the card offers is more akin to a $0 annual fee card, though the early check-ins and free bags are more than you might find elsewhere.

Foreign Transaction Fee

The card also charges a foreign transaction fee of 3% of the transaction cost in US dollars. That fee is standard for many cards but seeing such a feature on an airline card with a carrier specializing in discount travel to the Caribbean, Mexico, and South America is a letdown. Carefully consider how often you plan to travel abroad before applying to ensure you are getting the right card for your travel needs.

FAQs

Here are some of the most commonly asked questions regarding Southwest’s Rapid Rewards loyalty program:

- Yes. According to Southwest, you can request past flight points for up to 12 months after your flight. To claim points for a past flight, simply log into your account, select My Account and choose the Manage tab within My Rapid Rewards. Choose Request past points in the grey bar and enter your record locator (confirmation number) from your reservation. After verification of your flight information (up to 5 days), points will be deposited into your account.

- Rapid Rewards Dining is a rewards program within the Rapid Rewards program. This features lets members earn points from dining with select Southwest restaurant partners.

Related Article: Dining Programs: How to Earn Airline Miles with Any Credit Card

Chase Ratings

How does the card stack up? Here is a selection of expert reviews for the card, as well as an overview of JPMorgan Chase as a bank:

| BestCards | Better Business Bureau | TrustPilot |

|

4.5/5 |

3.5/5 |

2/5 |

Should You Apply for the Southwest Rapid Rewards® Plus Credit Card?

Overall, the Rapid Rewards Plus Card from Chase Bank is a decent co-branded airline card that pays its way in bonuses. The $69 annual fee is easily offset by the 3,000 bonus points received each cardmember anniversary, which has a cash value of approximately $45. The addition of the appealing sign-up bonus is another plus, as is the option of earning more points through Southwest’s various portals.

While double points on Southwest purchases and single points for all other purchases aren’t a major head-turner, they are respectable. Equally respectable are the airline-centric perks, including no hidden fees and two free checked bags on Southwest flights.

The presence of a foreign transaction fee is frustrating – especially given that there are plenty of other comparably priced airline cards that come with no foreign transaction fees. Fortunately, Southwest is mostly aimed at U.S.-based customers, meaning for the majority this card is a versatile travel tool that can quickly earn points towards free flights.

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.